missouri gas tax increase

The states last gas tax increase was approved in 1992 increasing the tax by 6 cents over a phase of five years. 1 2021 Missouri increased its gas tax to 0195 per gallon.

Should Virginia Suspend Recent Gas Tax Hike Lawmakers Considering It Wset

Going into 2018 the last gas tax increase in Missouri took place in 1996.

. The first increment increase happened Oct. The GOP-led House voted Tuesday 104-52 to raise Missouris 17-cent gas tax by 25 cents a year until it hits 295 cents per gallon in 2025. That window covers any fuel receipts from the period of October 1 2021 when the first gas tax increase took effect to June 30 2022 just before the next hike began.

The Missouri Gas Tax Referendum is not on the ballot in Missouri as an initiated constitutional amendment on November 8 2022. In addition to a gas tax increase last October Missouris motor fuel tax rate is set to bump up by 25 cents per gallon annually on July 1 through 2025. On July 1 2022 the gas tax will rise again to 022 per gallon.

Daniel Mehan President and CEO of the Missouri Chamber. The tax is distributed to the Missouri Department of Transportation Missouri cities and Missouri counties for road construction and maintenance. 4 rows Missouris fuel tax rate is 17 cents a gallon through September 30 2021 for all motor fuel.

Missouri receives fuel tax on gallons of motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis. 1 2021 and the. Beginning in October 2021 when the new law kicks in an additional 25 cents per gallon tax on motor fuel in Missouri will be collected.

It was part of an increase of 6 cents per gallon approved by the legislature in 1992 and phased in over five years increasing the rate from 11 cents per gallon to 13 cents per gallon in 1992 15 cents per gallon in 1994 and 17 cents per gallon in 1996. The five Republicans vying for Missouris 10th Senate District have a range of views on the states recent gas tax increase which has come under fire. At this time the State of Missouri has only offered a fIllable PDF form.

The amendment would have repealed Senate Bill 262 which authorized a gradual increase in the states gas tax by 0025 per gallon in each fiscal year until it reaches 029 per gallon on July 1 2025. Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct. Today the Missouri Legislature passed a 125 per gallon fuel tax increased to be phased in at the rate of 25 cents per year from 2021 to 2025.

Missouri Legislature passes 125 cent gas tax increase phased in over four years - headed to Gov for signature and its done. The tax will be 29 cents per gallon on July 1 2025 a 73 increase started in October 2021. Missouris current gas tax is 195 cents per gallon but its about to increase another 25 cents a gallon on July 1 making it 22 cents.

The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. Motorists across Missouri will start seeing higher gas prices Friday. 1 until the tax hits 295 cents per gallon in July 2025.

The tax was expected to provide the Missouri Department of Transportation with 500 million in additional revenue to improve roads and bridges. A 10-cent increase was turned. Missouris fuel tax was last raised in 1996 when the states legislature passed a 6-cents-per-gallon hike.

Under the legislation Missouris gas tax will rise for the first time in 25 years providing an estimated 510 million for road and bridge repairs each year once it is fully implemented. The Missouri senate bill 262 promised an EDI though Hilton said one is in the offing. Before the increase Missouris fuel tax was 17 cents per gallon the second-lowest in the nation.

The tax will increase an additional 25 cents per gallon in each fiscal year until reaching an additional 125 cents per gallon on July 1 2025. The first of five annual gas tax increases of 25 cents per gallon takes effect reaching a total increase of 125 cents by 2025. The tax increase could raise about 500 million dollars more.

At the end of 2025 the states tax rate will sit at 295 cents per gallon. Missouri is increasing the state gas tax 25 cents every year for the next few years until the gas tax reaches about 30 cents a gallon. Currently Missouri has the third-lowest gas tax in the nation.

Missouris current tax is 17 cents per gallon on all motor fuels including gasoline diesel and. The tax is passed on to the ultimate consumer purchasing fuel at retail.

Should Virginia Suspend Recent Gas Tax Hike Lawmakers Considering It Wset

Fuel Tax Relief Efforts Ramp Up At Statehouses Land Line State

Should Virginia Suspend Recent Gas Tax Hike Lawmakers Considering It Wset

Fuel Tax Relief Efforts Ramp Up At Statehouses Land Line State

Change To Bill Cutting Missouri Sales Tax On Food Transformed It Into Massive Tax Hike Missouri Independent

Representative Michael Davis Facebook

Should Virginia Suspend Recent Gas Tax Hike Lawmakers Considering It Wset

Change To Bill Cutting Missouri Sales Tax On Food Transformed It Into Massive Tax Hike Missouri Independent

Should Virginia Suspend Recent Gas Tax Hike Lawmakers Considering It Wset

Should Virginia Suspend Recent Gas Tax Hike Lawmakers Considering It Wset

How To Avoid High Gas Prices And Save Money Strategies Money

Missouri Gas Tax Refund Forms Now Available Local News Bransontrilakesnews Com

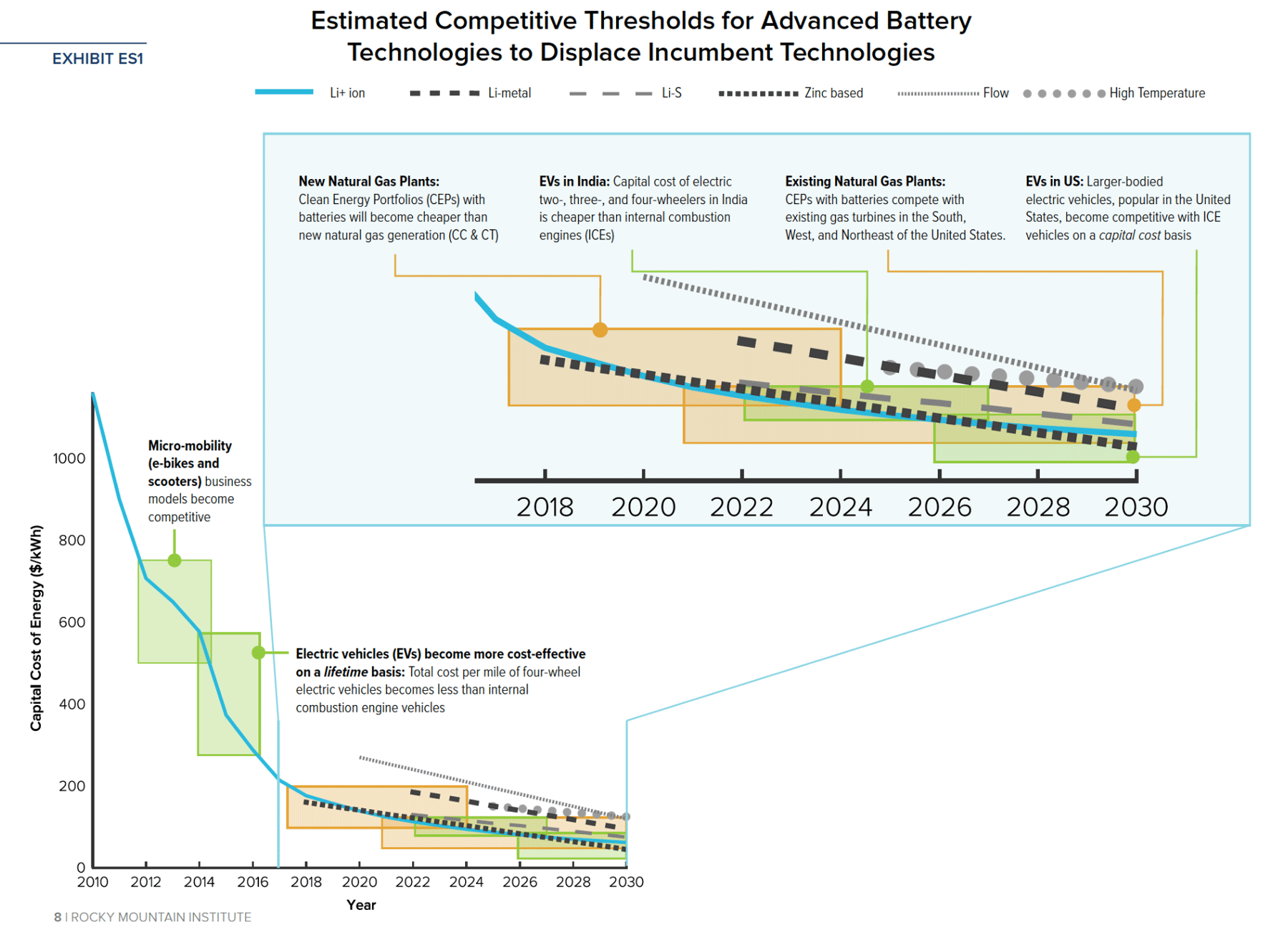

Energy Storage Breakthrough Energy Industry

Motor Fuel Taxes Urban Institute

/cloudfront-us-east-1.images.arcpublishing.com/gray/7XHDQPPEJZBZ5KYZIQRDPSCBE4.jpg)

Here S Where Sc Ranks For Most Expensive State Gas Tax In The Nation

Fuel Tax Relief Efforts Ramp Up At Statehouses Land Line State

Bp To Stick With Oil And Gas For Decades Ceo Looney Says Reuters

Fuel Tax Relief Efforts Ramp Up At Statehouses Land Line State

Illinois Considers Local Gas Taxes Atop Doubled State Gas Tax